Saying your boss paid the company’s credit card from his pocket, we’ll have to create a journal entry and an expense respectively. I wanted to ensure you’re able to reconcile your credit card account accordingly. To reconcile, simply compare the list of transactions on your bank statement with what’s in QuickBooks.

How to Use Email Blasts Marketing To Take Control of Your Market

Reconciling your accounts is a critical accounting function in your business and one that should be completed regularly. Although it’s relatively easy to undo reconciliation in QuickBooks Online, doing so should be a rare exception rather than something you do as a regular part of https://www.quick-bookkeeping.net/ your bookkeeping process. Billie Anne is a freelance writer who has also been a bookkeeper since before the turn of the century. She is a QuickBooks Online ProAdvisor, LivePlan Expert Advisor, FreshBooks Certified Partner and a Mastery Level Certified Profit First Professional.

How To Enter Credit Card Charges In Quickbooks

If you’re reconciling an account for the first time, review the opening balance. It needs to match the balance of your real-life bank account for the day you decided to start tracking transactions in QuickBooks. To gather the statements effectively, you can access them through your online account or request them directly from the credit card issuer. Having accurate documentation simplifies the reconciliation process and helps in identifying any discrepancies or errors. Be careful not to reconcile transactions that are not yet cleared or present on your bank statement. Utilize the Items you’ve marked cleared section to compare the summary totals with those on your bank statement.

Step 1: Examine your opening balance

If unmarked transactions are legitimate, they need to be added to QuickBooks. Once added, mark the transaction as cleared by clicking the radial button in the right-most column. If your sidebar menu is not what is shown in our tutorial, it means that you are on Business View. We prefer and recommend using the Accountant View because it shows a full range of business accounting features and tools that you can use in QuickBooks. Also, you can consult your accountant to make sure the recording is accurate. You can ask your accountant if you need more assistance in determining the correct posting accounts.

It allows you to identify any discrepancies and resolve them promptly, providing you with a clear and up-to-date understanding of your business’s financial health. If the credit card statement shows a negative balance, an over-payment, enter the negative balance as you start the reconcile process. Then when you mark off all the transactions that cleared, the totals will match as usual.

- Anything dated earlier is an error and should be cleaned up before you finalize the reconciliation.

- If you’re not affiliated with one, you can utilize our Find an Accountant tool to look for one in your area.

- Account reconciliation in QuickBooks is a pivotal task for maintaining accurate and reliable financial records.

- One common task that your finance teams have to handle every month even if they don’t like it is reconciling credit cards.

You enter the balance of your real-life bank account for whatever day you choose. We recommend setting the opening balance at the beginning of a bank statement. It will guide you in ensuring the QuickBooks amounts match your real-life bank and credit card statements. NerdWallet independently reviews accounting software products before determining our top picks.

Connect QuickBooks to your bank, credit cards, PayPal, Square, and more1 and we’ll import your transactions for you. When you receive your bank statement or account statement at the end of the month, you’ll only spend a minute or two reconciling your accounts. QuickBooks organizes your data for you, making bank reconciliation easy. Just like balancing your checkbook, you need to review your accounts in QuickBooks to make sure they match your bank and credit card statements. Reconciling credit cards in QuickBooks Online involves specific steps to ensure accurate financial management and alignment with credit card statements. Ensuring that you collect all the online and desktop usage statements is crucial as it provides a comprehensive overview of your spending.

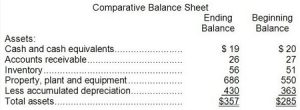

Common causes of these discrepancies include missed transactions that are in the bank statement but not in QuickBooks, duplicate transactions recorded more than once, and incorrect transaction amounts. To resolve these issues, add any transactions that are missing in QuickBooks, delete or merge any duplicate entries, and correct the amounts for transactions that have been inaccurately recorded. Select the appropriate bank or credit card account to reconcile the lower of cost or market of inventory from the Account field. Ensure that the Statement Date in QuickBooks Desktop corresponds with your actual bank statement, making adjustments as needed. QuickBooks Desktop will automatically generate a Beginning Balance based on your last reconciliation. Finally, after identifying and resolving these discrepancies, adjustments are made to the financial statements to reflect the reconciled balance, ensuring accuracy and consistency in the financial records.

Once the matching is complete, and the difference between your bank statement and QuickBooks Desktop shows $0.00, proceed to finalize the reconciliation by selecting Reconcile now. After completing the reconciliation, you have the option to display or print the Reconciliation report for record-keeping. If you notice any discrepancies https://www.accountingcoaching.online/how-do-accounts-payable-show-on-the-balance-sheet-2/ or issues during the verification process, take the time to investigate and resolve them. This may involve reviewing transactions, contacting your credit card provider, or seeking assistance from a financial professional if needed. Make sure you enter all transactions for the bank statement period you plan to reconcile.

Other features include inventory tracking, reporting, invoicing, project management tools and the ability to categorize transactions using classes. As for the vendor credit card, there’s no need to set up a separate vendor for each transaction. The key point here is that you use the credit card account when making the payment.

We recommend reconciling your current, savings, and credit card accounts every month. Check out our complete reconciliation guide to understand the full workflow. Generally reconciling credit card accounts is much easier than bank accounts since you don’t have to deal with outstanding checks. Sometimes you have a transaction or two that crosses the end of the statement cycle, but that’s about it for outstanding transactions. If you see old outstanding transactions on a credit card reconciliation, you know you have accounting errors to clean up.

After completing the previous step, QuickBooks will display a screen with a summary of the reconciliation in the top half and detailed transactions in the bottom half. When you’re done reviewing your statement, you’ll know everything made it into QuickBooks. Click Save & Close, and the transaction is added to the reconciliation screen.

Consider one of the following solutions if those on our list above don’t suit your small-business accounting needs. Here are NerdWallet’s picks for the best small-business accounting software, including why we selected each product, monthly price details and features checklists for easy product comparisons. We’ve also included a couple of solutions that nearly made our list and a few products you can skip.

Also, try never to force a reconciliation by posting to the Reconciliation Discrepancies account. Only then should you post to the Reconciliation Discrepancies account. If you’ve identified any errors on the statement, contact your financial institution at once so they can investigate. When you finish reconciling accounts, QuickBooks automatically generates a reconciliation report. It summarizes the beginning and ending balances, and it lists which transactions were cleared and which were left uncleared when you reconciled.

This lets them save and comment on invoices, save their payment information, invite others to access the account and collaborate on projects they’ve been invited to view. There’s also an Apple Watch app that lets you track time, send payment reminders and review outstanding invoices. Unlike some competitors, none of Zoho Books’ plans put a limit on billable clients, and even its free plan lets you send up to 1,000 invoices per year. On top of that, the free option offers a customer portal, automatic payment reminders, mileage tracking and the ability to schedule reports.